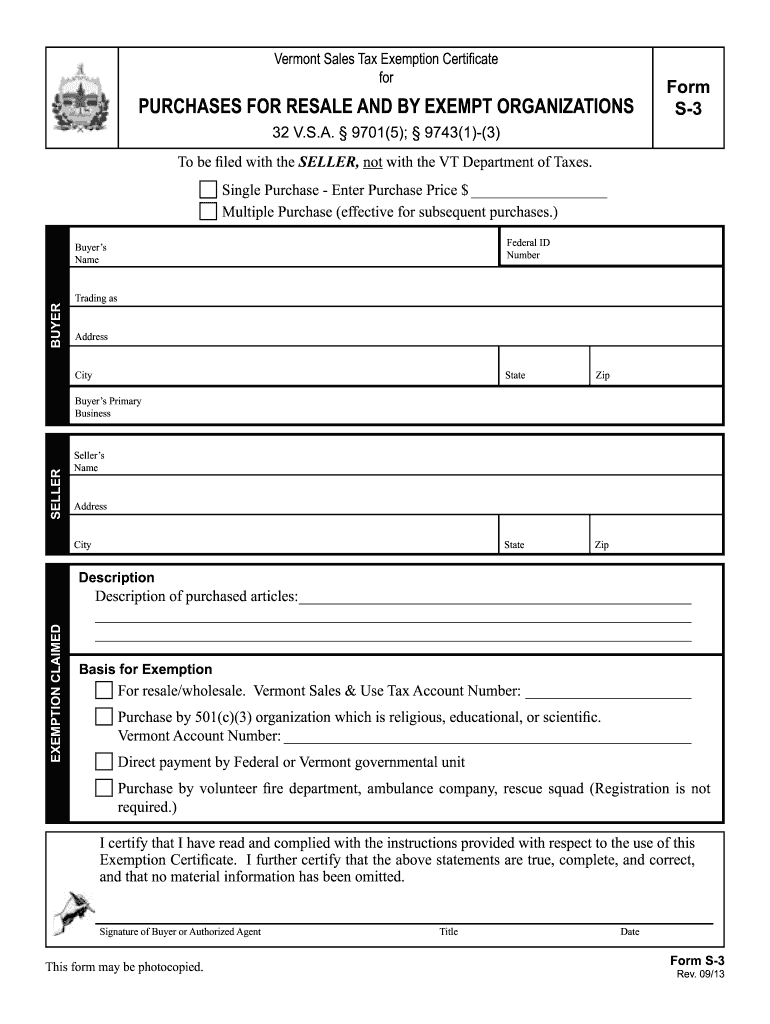

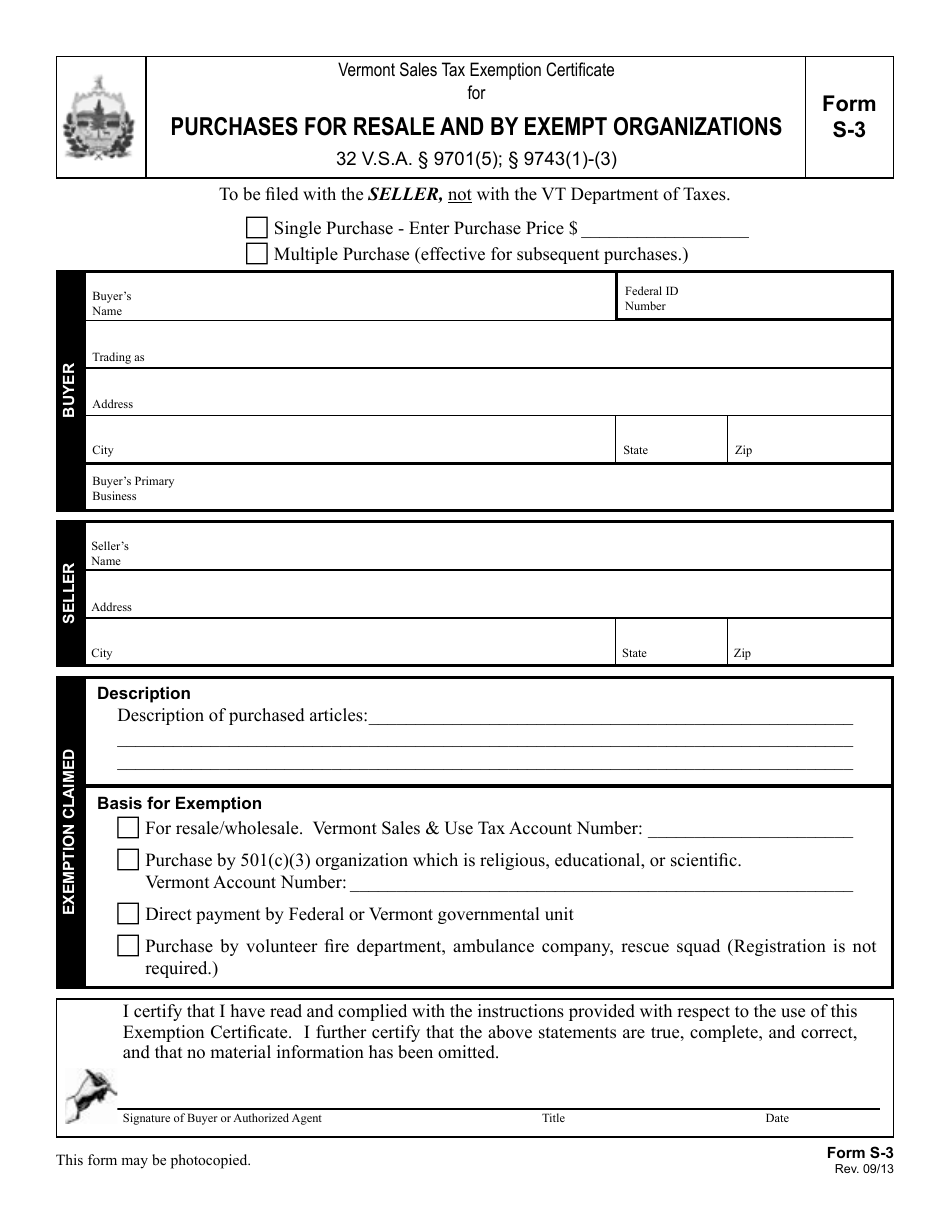

vermont sales tax exemption certificate

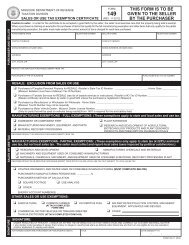

Provide vendor with completed Sales Tax Exempt Purchaser Certificate Form ST-5 PDF and copy of Form ST-2 Certificate of Exemption PDF with Renewal Notice Exemption No. Multiple Purchases - Description of purchased articles.

The burden of proof that the tax was not required to be collected is upon the SELLER.

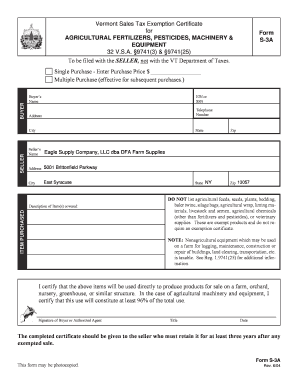

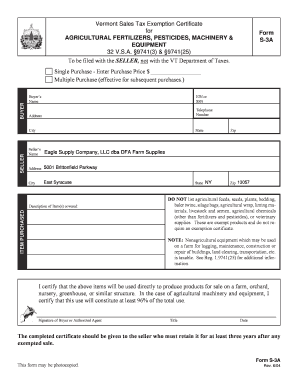

. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax. You can easily acquire your Vermont Sales Tax License online using the VTBizFile Business Taxes Online website. Vermont Sales Tax Exemption Certificate for Agricultural Fertilizers Pesticides Supplies Machinery Equipment 32 VSA.

In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate. Get Your Vermont Sales Tax License Online.

STATE OF VERMONT DEPARTMENT OF TAXES 109 STATE STREET MONTPELIER VERMONT 05609-1401 RESALE AND EXEMPT ORGANIZATION CERTIFICATE OF EXEMPTION TITLE 32 97075. How to use sales tax exemption certificates in Vermont. Vermont Sales Tax Exemption Certificate for AGRICULTURAL FERTILIZERS PESTICIDES MACHINERY.

RETENTION OF CERTIFICATES Certificates must be retained by the seller for a period of not less than three 3 years from the date of the last sale covered by the certificate. The exemption certificate the sales slip or invoice must show the buyers name and address sufficient to link the purchase to the exemption certificate on file. Other typesofexemptioncertificatesthatmay be applicable are ava ourwebsiteat.

You can download a PDF of the Vermont Streamlined Sales Tax Certificate of Exemption Form SST on this page. 503 ˇ ˆ. The Sales Tax Permit allows you to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows you to make tax-exempt purchases for products intended for resale.

For questions regarding how these exemption certificates. Sales Tax Exemptions in Vermont. This certificate is used to document exemption from Vermont sales tax provided by Title 32 Vermont Statutes Annotated 974125 for agricultural machinery and equipment for use and consumption directly and exclu-.

The buyer must read and follow all instructions on page 3 prior to completing and signing. For other Vermont sales tax exemption certificates go here. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax.

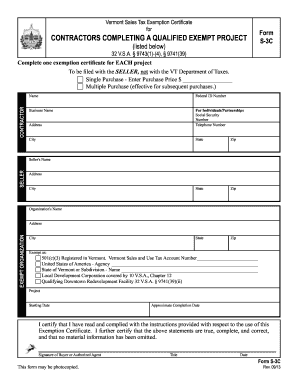

For questions regarding how these exemption certificates may be properly applied please contact the Vermont Department of Taxes at 802 828-2551 option 3. With a Vermont Sales Tax Permit youll obtain a Sales Use Tax Account Number for use when filling out the resale certificate. 197 41 3 197 41 25 Form S-3A Note for the BUYER.

The state of Vermont became a full member of Streamlined Sales Tax on January 1 2007. An example of an item that is exempt from Vermont sales tax are items which were specifically purchased for resale. 197413-1 197413-2 19741 25 1-7 FORM S-3A To be filed with SELLER not the Department of Taxes.

Only valid exemption certificates protect a business from assuming responsibility for the sales tax on the exempt transactions. This exemption certificate applies to the following. For questions regarding how these exemption certificates may be properly applied please contact.

Taxability Matrix Library of Definitions. Failure to obtain an exemption certificate at the time of sales may leave a business with the responsibility to pay the tax to the state if assessed under audit by the state. You can download a PDF of the Vermont Streamlined Sales Tax Certificate of Exemption Multistate Form SST-MULTI on this page.

View a list of available meals and rooms tax exemptions and exemption. Check out the rest of this guide to determine who needs a sales tax permit what. 974125 Form S3A To be filed with the SELLER not with the VT Department.

97431-3 Suppliers Name Street City Town or PO State and Zip Single Purchase - Enter Purchase Price. 97 41 3 97 41 25 and Reg. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

No exemption from separate MA room occupancy excise tax. On making an exempt purchase Exemption Certificate holders may submit a completed Vermont Sales Tax Exemption Form to the vendor instead of paying sales tax. 97431-3 ˇ.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. A Vermont Certificate of Exemption is a document that allows a business to purchase goods and services tax-free from suppliers for the purpose of reselling those goods and services. Taxability Matrix Tax Administration Practices.

Vermont Sales Tax Exemption Certificate for AGRICULTURAL FERTILIZERS PESTICIDES SUPPLIES MACHINERY EQUIPMENT 32 VSA. Business and Corporate Exemption Sales and Use Tax. Companies or individuals who wish to make a qualifying purchase tax-free must have a Vermont state sales tax exemption certificate which can be obtained from the Vermont Department of Taxes.

Exempt from sales tax on purchases of tangible personal property and meals not rooms. 97413 974125 and Reg. Other types of exemption certificates that may be applicable are available on our website at.

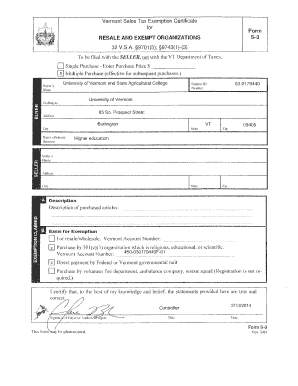

Erly executed exemption certificates shall be deemed to be taxable retail sales. The certificate is also sometimes referred to as a resale permit or a resellers permit. Vermont Sales Tax Exemption Certificate for Form RESALE AND EXEMPT ORGANIZATIONS 32 VSA.

The seller must retain an exemption certificate for every transaction. S-3pdf 8943 KB File Format. Exemption certificates are not filed with the Vermont Department of Taxes but the seller must produce an exemption certificate when it is requested by the Department.

Other types of exemption certificates that may be applicable are available on our website at. For other Vermont sales tax exemption certificates go here. If you have quetions about the online permit application process you can contact the Department of Taxes via the sales tax permit hotline 802 828-2551 or by checking the permit info website.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing. The exemption certificate the sales slip or invoice must show the buyers name and address sufficient to link the purchase to the exemption certificate on file. Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit.

Vermont Tax Exempt Form Agriculture Fill Online Printable Fillable Blank Pdffiller

Zillow Has 260 Homes For Sale In Berea Ky View Listing Photos Review Sales History And Use Our Detailed Real Estate Filters To Find The Tremont Berea Zillow

Printable Vermont Sales Tax Exemption Certificates

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

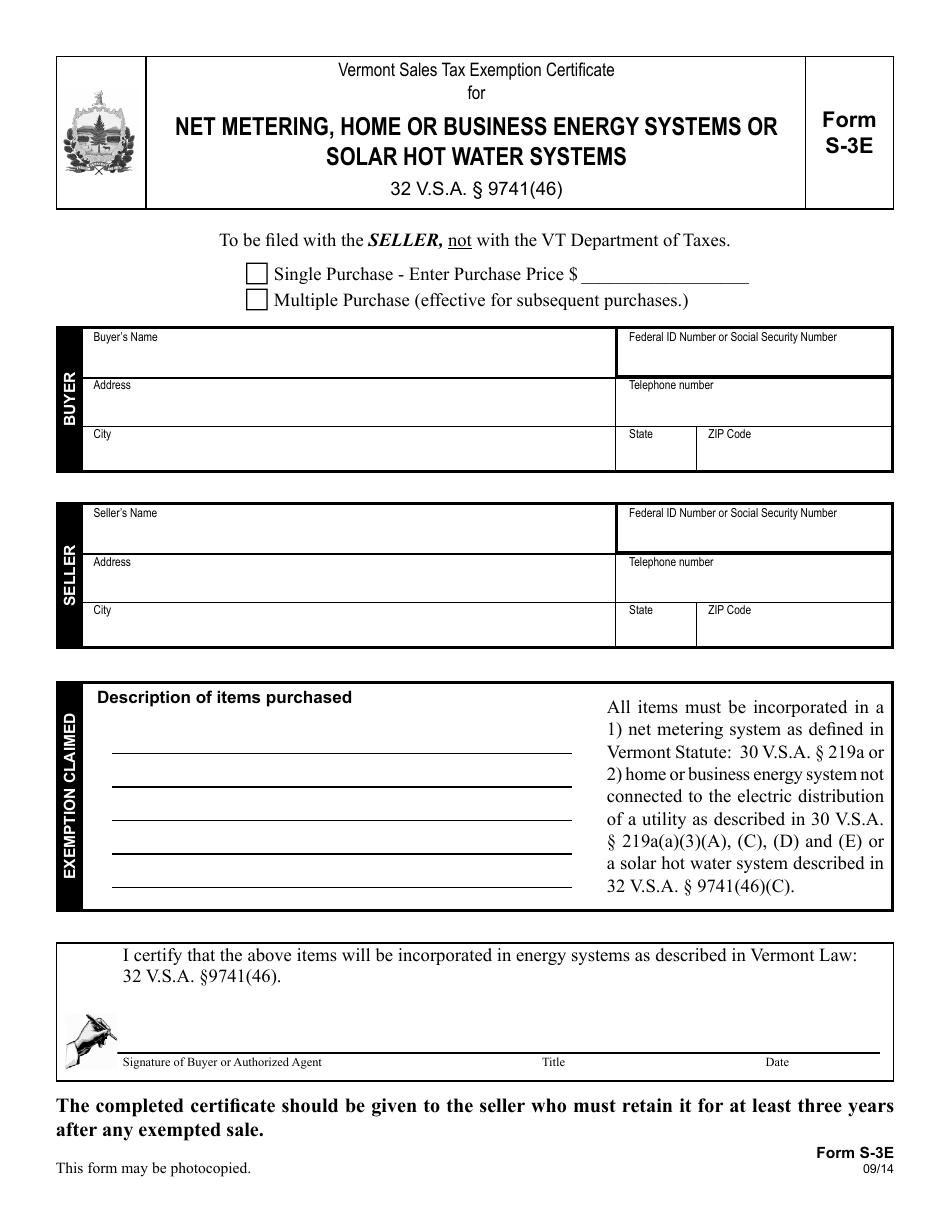

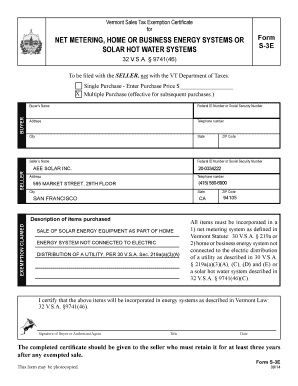

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

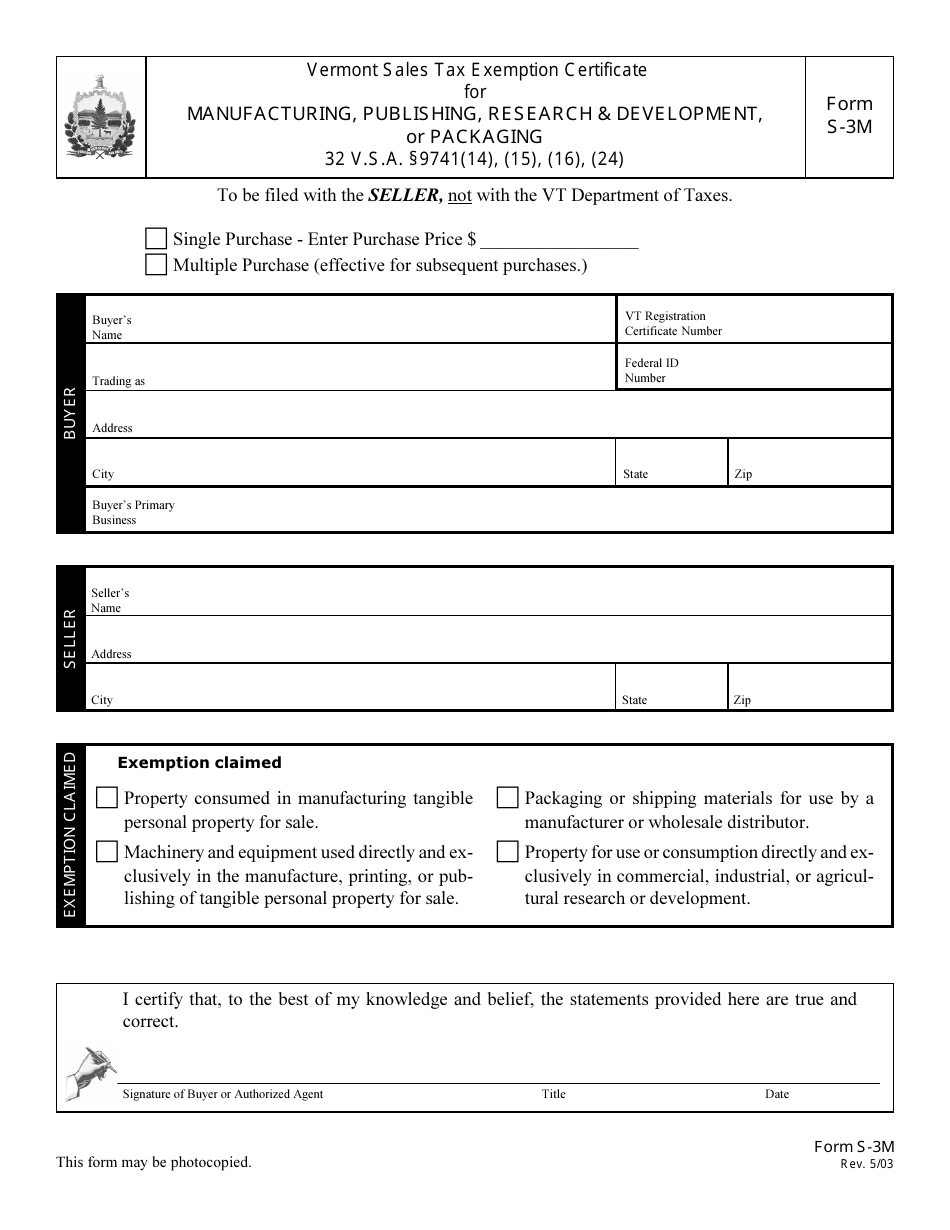

Vt Form S 3m Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Manufacturing Publishing Research Development Or Packaging Vermont Templateroller

Vermont Sales Tax Exemption Certificate For Form S

Vermont Sales Tax Exemption Certificate For Form S

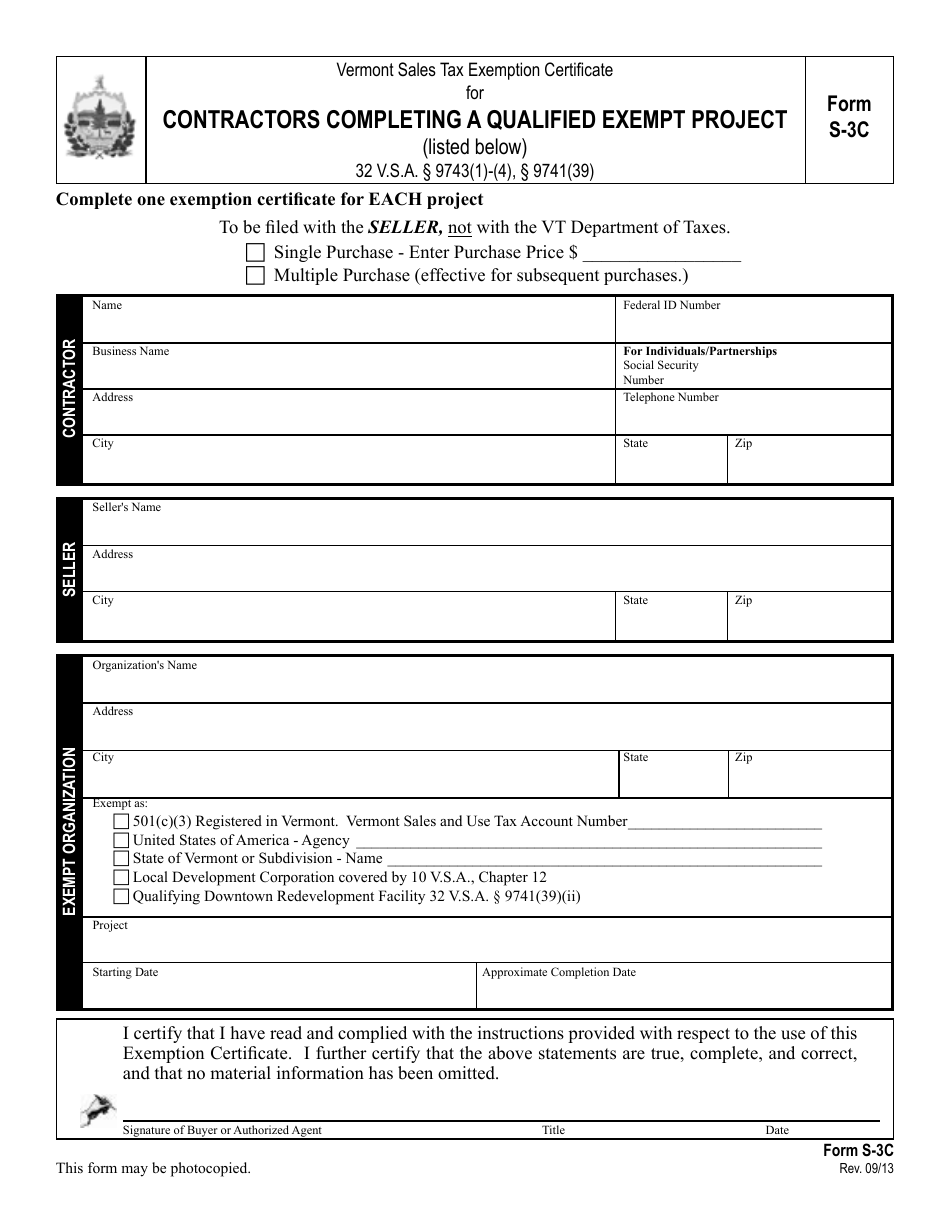

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Vermont Sales Tax Exemption Certificate For Form Agricultural Fill And Sign Printable Template Online Us Legal Forms

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Vermont Sales Tax Exemption Certificate For Form S

Vermont Tax Exempt Forms Fill Out And Sign Printable Pdf Template Signnow

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Fillable Online Department Of Taxation Sales Tax Exemption Certificate Form S 3e Fax Email Print Pdffiller